The "Cleveland Massacre" -- Standard Oil makes its First Attack

Dan Bryan, April 15 2012

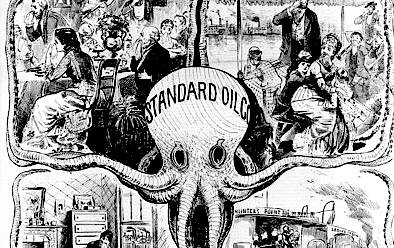

Press coverage of Standard Oil was not always favorable

Press coverage of Standard Oil was not always favorableBefore 1872, Rockefeller was just another prosperous businessman, not particularly well known in the public eye. Then in one swoop he bought out most of the Cleveland refiners and positioned himself for national control of the oil industry.

His victory was so complete that opponents labeled it the "Cleveland Massacre".

Overproduction and depression in the Cleveland refining industry

By the late 1860s, the formerly booming oil business was mired in a slump. Too many producers had thrown their hats into the game, and the refining capacity of Cleveland was triple the amount of oil being pumped. Through years of shrewd maneuvering, hard work, and good business sense, Rockefeller had forced his own partnership to the top of this unstable edifice. His was one of the few that wasn't losing money.

Rockefeller had a new partner whom he trusted and related to much more than his old ones -- Henry Flagler. Flagler convinced Rockefeller to form a corporation which could take the offensive against their rivals.

Henry Flagler, around the time that Standard Oil was founded

Henry Flagler, around the time that Standard Oil was foundedFlagler drew up the act of incorporation himself on a piece of yellow legal paper, and "Standard Oil" was officially registered on January 10, 1870.

Standard Oil's first moves

Standard Oil couldn't do anything until it attracted financing. Most banks would have little to do with an oil company -- not when they could open the newspaper and read about the latest refinery explosion, teamster extortion, or production glut. Rockefeller could obtain some loans, but not on the scale that he desired.

It took two years after the formation of Standard Oil for that company to bankroll itself enough to go on the attack. During this time arrangements were made with New York shippers, operations were simplified, and profits were increased.

In 1871, Rockefeller was confident enough to declare a 40% dividend on Standard Oil stock. It was an unusual move for an expanding company, but it had the intended effect. Bankers with real money took notice, and the legitimacy this provided more than offset the large payout in cash reserves.

Rockefeller's two-front strategy of expansion

Standard Oil's big move started on New Year's Day, 1872. On that very day, a spate of new investment tripled Standard's capital -- from $1 million to $3.5 million. Much of this money came from New York banks and wealthy financiers, who were enticed into the refining market for the first time by the strength of Standard Oil.

Rockefeller's objective with this new capital was to force the complete and total capitulation of his competitors in the Cleveland refinery business.

There were two prongs to the attack. In the first campaign, a combination with the railroads would attack the oil producers in Pennsylvania, driving down shipping costs and standardizing rail rates. On the basis of guaranteed shipments, Standard Oil would receive bulk rate discounts, creating an insurmountable advantage against his competitors.

Concurrently, Rockefeller would approach competing refineries in Cleveland and eliminate them. After laying out all of the advantages that Standard enjoyed with financing, shipping, marketing, and so on, he would present a generous buyout offer to each competitor. They could either accept or be driven into bankruptcy.

The South Improvement Company's price fixing efforts

Rockefeller was not the only businessman trying to make sense of the oil markets. Three separate railroads competed for the right to carry oil from Cleveland to New York, and their management was eager to make a truce in this price war. Thus, to guarantee shipments of oil to each firm, in a constant ratio, they established the South Improvement Company and enlisted Rockefeller.

Rockefeller used his connections to oil buyers in New York to expand upon the alliance. While Standard Oil wasn't the only oil company included in this arrangement, they were the main representative from the Cleveland market.

Here is how each party benefited:

- Railroads - The Pennsylvania, Erie, and New York Central railroads would receive regular oil shipments at a guaranteed ratio. This would end the chaotic price wars they engaged in, and allow for each concern to turn a profit on their oil shipments.

- Trading houses - Firms in New York would receive the right to purchase oil at fixed rates as well. This would increase the stability of their trade, and allow them to make a consistent profit on East Coast and overseas sales. One of the largest firms - Bostwick and Tilford - had been covertly acquired by Standard Oil in 1871.

- Refineries - Standard Oil and others would receive rebates on their oil shipments, in return for guaranteed volume (again, spread among the participating railroads). Competing refineries with smaller shipments would be charged higher rates.

The losers were the oil drillers, refineries, and traders who were left out of the loop. The drillers would lose most of their pricing leverage, while the refineries and traders who did not have fixed, low prices would be unable to compete with Standard Oil and its favored trading houses.

Riots in the Pennsylvania oil fields

As with so many conflicts, the initial salvo was fired impetuously. A subordinate Pennsylvania Railroad employee had been left in charge while his manager visited a sick relative. On February 26, 1872 this man prematurely posted the new shipping rates in Oil Creek, Pennsylvania. The rates doubled for everyone -- everyone except for Standard Oil and a couple other refineries.

Traders pose for a photo in Oil City, Pennsylvania - 1870 (click for more info)

Traders pose for a photo in Oil City, Pennsylvania - 1870 (click for more info)The result was a series of riots in the muddy oil towns. Three thousand people entered the Titusville Opera House and shouted slogans against Standard Oil and the Pennsylvania Railroad. Standard Oil signs were defaced with skulls and crossbones. The newspapers printed a blacklist of refineries every morning on the front page -- with Standard Oil at the top. Drillers who were caught selling to the blacklist were assaulted by mobs and beaten senseless. Saboteurs attacked Standard Oil shipments and destroyed Pennsylvania Railroad track.

Hate mail and death threats flowed into Rockefeller's office. He hired a team of private security and slept with a loaded revolver in reach. On the national level, many people had not yet heard of Rockefeller. Now they opened their newspapers and read of the turbulence in Pennsylvania, and their first glimpse of the man was not a flattering one.

On April 8th, the South Improvement Company charter was revoked by the state of Pennsylvania. To all outward appearances, it looked as if Standard Oil and its friends had been routed.

The "Cleveland Massacre" begins

Lost by many in the outrage, Standard Oil had undertaken a second line of attack, and it met with outstanding success.

When Genghis Khan's army swept through the steppes of Asia, their preferred strategy was to intimidate opposing armies into surrender without battle. Those who did submit were treated well while those who resisted were annihilated. Whether he read history or not, Rockefeller intuitively applied these tactics to the business world.

One-by-one, Rockefeller personally approached Standard Oil's competitors in Cleveland and made three simple points:

- The refining business was overpopulated and most refiners were losing money. It was only a matter of time before most of them went bankrupt (including, presumably, the refinery that Rockefeller was meeting with).

- Standard Oil had the power and influence to manipulate shipping rates. Even if the South Improvement Company failed, there would be other attempts. Competitors lacked the clout to compete with Standard Oil on these deals.

- Standard Oil was profitable and growing, and it was willing to make a generous offer to buy the competing refinery out.

It was at this point that the accounting books of Standard Oil would be pulled out -- presenting a story of profit and cash reserves that cowed most competitors into submission. Rockefeller told them,

"Take Standard Oil stock, and your family will never know want."

It was an offer that most refineries couldn't refuse, for once they saw the books of Standard Oil, they knew that their defeat was inevitable. Most who took the deal became rich men and some were offered lucrative positions within Standard Oil.

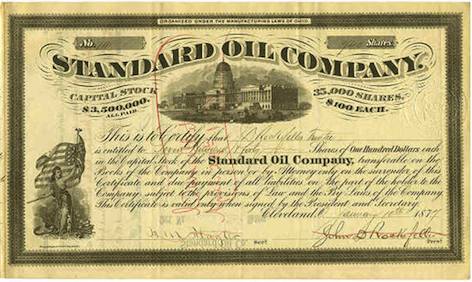

Rockefeller's preferred weapon was Standard Oil stock

Rockefeller's preferred weapon was Standard Oil stockIn a poetic turn of events, one of the men who sold out was the very first man who hired Rockefeller, when he was applying for bookkeeper jobs before the Civil War. That person certainly had ample time to reflect upon the strange turns of life.

And what of those who resisted? Grant, Foote, and Company was the largest example. Its partners refused to work with Rockefeller and competed for a couple more years, but they were crushed. Instead of receiving a buyout and Standard Oil stock, they fell from the heights of Cleveland society into bankruptcy.

The lessons of Rockefeller's victory

In just three months, in the methodical fashion of a godfather, Rockefeller eliminated twenty-two of his twenty-six competitors in Cleveland. At the end he was left unchallenged in that city.

Whether by design or by coincidence, Rockefeller had provided a masterful example of using diversionary tactics to distract the attention of the media. While the South Improvement Company dominated the public attention, the "Cleveland Massacre" went almost unnoticed. The Pennsylvania drillers woke up after their victory and realized -- to their horror -- that while they might have saved their right to competition among the refineries, Standard Oil had destroyed them.

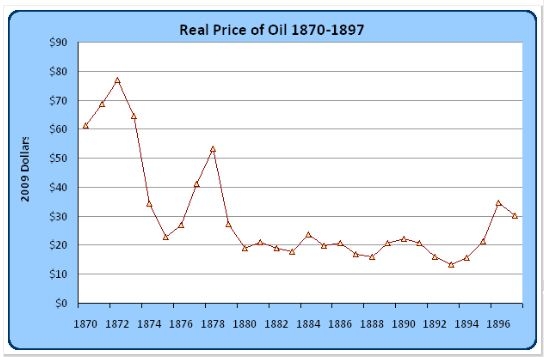

Just because Rockefeller used aggressive business tactics didn't mean that he could overlook the quality of his products. Standard Oil kerosene sold well and was appreciated for its consistency, and the company was much more profitable and better managed than most of its competitors. The price of oil also greatly decreased as Rockefeller expanded his control of the industry.

What was Rockfeller's opinion of the situation? A textbook definition of offensive realism. As he later explained,

"It was forced upon us... We had to do it in self-defense. The oil business was in confusion and daily growing worse. Someone had to take a stand."

The ambition of John D. Rockefeller would not be satisfied by supremacy in Cleveland, Ohio. He immediately cast his eyes upon the rest of the country -- the world even -- and resolved to use the same tactics on a much greater scale. He wanted nothing less for Standard Oil than complete control of the global oil market.

Recommendations/Sources

- Ron Chernow - Titan: The Life of John D. Rockefeller, Sr.

- Daniel Yergin - The Prize